If you weren’t paying close attention to the markets last week, you may have missed the latest financial imbroglio, triggered by the rise in value of Japan’s currency, the yen, in the wake of the Bank of Japan raising short term interest rates. You still with me?

A chain of events that led to an unwinding of a curious Wall Street trade that spooked markets and prompted Donald Trump to make wild accusations about who was culpable for the volatility; accusations filled with standard fare red herrings and ad hominem attacks directed at his rivals—attacks, mind you, that ignored or outright obfuscated the real catalysts and culprits of the market turmoil.

At first glance, a discussion about foreign currency valuations, interest rate hikes and DJT embellishing for political points for the trillionth time may sound like a snooze. But it was arguably the meatiest, most under-hyped story last week, because it pulled back the curtain, if ever so slightly, on Wall Street’s Den of Vipers latest contrivance, and therefore is worth revisiting.

Tokyo & Trump Timeline

In the middle of a multi-day but short-lived global selloff that picked up steam on Wednesday July 31, and climaxed in the premarket Monday morning August 5, Trump and his sycophants saw a window of opportunity to knock Joe Biden and Kamala Harris down a peg or two.

Late on Sunday night, August 4, while U.S. markets were still shuttered for the weekend, Trump took to his social media platform, the publicly traded and incongruously named Truth Social, to write in all caps:

“STOCK MARKETS CRASHING. I TOLD YOU SO!!! KAMALA DOESN’T HAVE A CLUE. BIDEN IS SOUND ASLEEP. ALL CAUSED BY INEPT U.S. LEADERSHIP!”

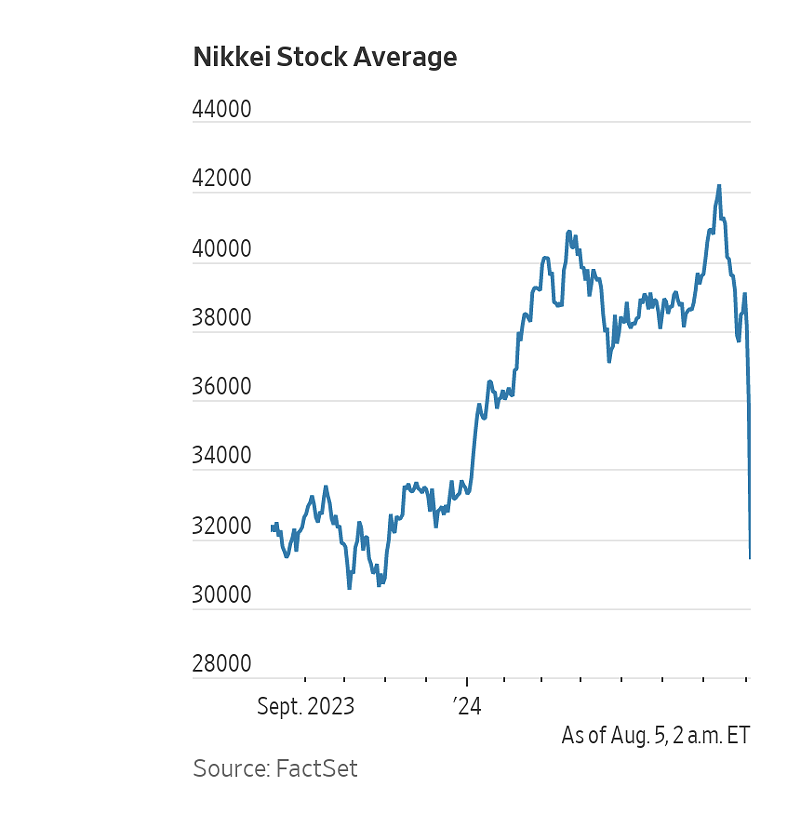

At the time of Trump’s post, it was Monday afternoon in Tokyo, and Japan’s stock index, the Nikkei 225, was in the middle of a full meltdown. By the end of the trading day, the Nikkei would drop 12.4% after losing 5.8% the previous Friday. According to the Wall Street Journal, this “once-in-a-generation free fall” was Japan’s largest single-day sell-off since Oct. 20, 1987, the Tuesday after the infamous 1987 “Black Monday” U.S. stock market crash that sent the Dow Jones Industrial average tumbling 22.6%.

Subsequently, on Monday morning here in the states, 13 hours behind Tokyo, the contagion would hit lower Manhattan after spreading throughout Asia — South Korea’s KOSPI fell 9%, Taiwan’ Taiex dropped 8.4%, while India’s Sensex closed down almost 2.7% down.

The S&P would open down 3.5%, “with fewer than 50 stocks in positive territory, while the Nasdaq slumped more than 5%,” as reported by Business Insider.

Worse yet, at 8:30 AM, an hour before the bell in premarket trading, the VIX, an important volatility indicator, also known as Wall Street’s “fear gauge,” which had remained depressed for months due to an unrelenting bull market, spiked dramatically from Thursday-afternoon’s low of 15.71, shooting to a high of 65.73, “the highest level since the pandemic market plunge in 2020,” according to CNBC.

Importantly, 8:30 AM would also prove to be a key technical pivot point, as buyers from big institutions, using complex (and opaque) algorithmic trading technology, jumped back into the market on heavy volume.

From this time stamp forward, stocks would rebound throughout the day and never let up — a key fact no one in legacy media cared to mention. Moreover, the buying momentum would carry over into Tuesday’s trading session, as stocks and indexes closed in the green, while the VIX would conversely fall back below 25, as The Fear quickly subsided.

But by now, Trump, like a rabid dog, had tunnel vision. Ignoring the signs of a reversal, after having devised a new alliterative nickname to pigeonhole yet another political opponent, at 10:02 AM Trump posted again to Truth Social, this time to brand Vice President Kamala Harris, “KAMALA CRASH”!

Following suit, fifteen minutes later, the House GOP Judiciary Committee tweeted, “If you look at your 401k today, remember that it was brought to you by Kamala Harris and Joe Biden.”

Even Trump's running mate Sen. JD Vance, got in on the action. The multi-millionaire author of the 2016 memoir Hillbilly Elegy, and former venture capitalist, whose senate campaign was partially financed (to the tune of $15 million dollars) by his former boss, the conservative Silicon Valley billionaire and self-professed monopolist Peter Theil, wrote:

“This moment could set off a real economic calamity around the globe. It requires steady leadership — the kind President Trump delivered for four years. Kamala Harris is too afraid to answer media questions and cannot lead us through these troubled times.”

But nowhere in these reductive broadsides, described as “toddler tantrums” by one New York Times editorial, did Trump or his underlings provide any data or context around current market conditions, the cause of Japan’s crash, or the real saga hiding in plain sight: Wall Street’s latest leveraged scheme.

Background on Market Dynamics and Yen Carry Trade

Despite high interest rates and sticky inflation numbers, serious fears of a recession at the start of the year were averted due to both a strong labor force and soaring Big Tech stocks, fueled by an exuberant, if not propagandistic, AI innovation narrative that helped propel an indefatigable rally in all three major U.S. stock indexes.

The market-cap-weighted S&P hit new all-time highs 31 times in the first six months of the year, led by the “Magnificent Seven” mega-cap tech stocks — Nvidia, Tesla, Meta, Apple, Alphabet, Microsoft and Amazon — but especially by the semiconductor Nvidia, which gained nearly 150% in the first half of the year.

Nevertheless, because the pump was so unbridled and narrowly focused around AI euphoria, Wall Street analysts have been predicting for some time, while not raising alarm bells about when, a healthy correction to the bullish buying mania would come. Last month that correction came, as bears at least temporarily took back control, while the “smart money” from large institutions began “rotating” out of overbought growth stocks.

But overbought mega-caps wasn’t the only factor weighing on traders and investors minds that contributed to selling pressure.

On July 31, at the Federal Reserve’s news conference, Chair Jerome Powell announced, to some surprise, the Fed would keep interest rates elevated for yet another month — between 5.25% and 5.5%. While Powell signaled they would finally make their first rate cut in September, concerns the central bank was cutting too late, and thus getting behind the curve, reinvigorated new fears of a recession and led to further selling.

The weight of the Fed’s decision was also compounded two days later by the Friday’s jobs report released on August 2. Although the labor market was still adding jobs, the rapid pace coming out of the pandemic had slowed, and July’s unemployment numbers grew to their highest levels since 2021, as reported by the Labor Department.

Furthermore, July kicked off the second quarter earnings season. Multiple big tech companies — from Google to Microsoft to Amazon — issued results that according to the Financial Times, “underwhelmed investors.”

Each of these catalysts played a role in recent market volatility, and one could tangentially try to link them to the White House.

But they weren’t THE story. The flash global selloff and sharp spike in the VIX last Monday had less to do with traditional stock rotation, the Fed’s intransigence, lackluster employment numbers, spotty tech earnings, or for that matter, Biden’s and Harris’s policies, and more to do with Wall Street’s latest Big Bet, in the world’s largest casino, that finally went bust.

A widely made bet across Wall Street but fairly shrouded from Main Street’s gaze, which once uncovered, would explain the symbiotic relationship between the tectonic rise of Big Tech stocks and subsequent rapid crash of Japan’s stock market.

The Yen Carry Trade

Since the 1990s, after a Japanese asset bubble burst, and followed by a period of deflation, Japan made it a priority to keep interest rates at hyper low levels for decades.

Even coming out of the pandemic, when many central banks around the world began to raise rates to fight rampant inflation, Japan stayed the course and kept rates suppressed, even in negative territory.

According to Business Insider, this created “a divergence in monetary policy that affected the Japanese yen, which sank to a near four-decade low against the strong US dollar last month.”

This currency divergence created a trading opportunity, known as the carry trade that became in vogue among large Wall Street institutions, especially in the last several years amidst U.S. rate hikes that on the one hand made borrowing expensive at home, and on the other, helped turn Japan into the largest creditor nation in the world.

Investment banks, hedge funds and currency traders, all hunting for value and/or ways to manufacture money out of thin air, found a magical haven in Japan, and began borrowing vast sums — no one knows exactly how much, some estimates are upwards of a trillion dollars — of the devalued yen at or below zero percent interest rates.

Once the money was borrowed, these institutional players then “carried” the interest-free cash over, pouring it back into other asset classes that could produce a sizable return, i.e., U.S. treasuries, the Mexican peso, Big Tech stocks, as well as riskier assets like Bitcoin.

The banks and hedge funds were BETTING that both the Japanese currency would continue to flounder or fall in relation to the strong dollar, while Japan’s central bank would continue to keep interest rates at near zero levels. If the levels stayed the same, they could continue to leverage the capital they’d borrowed with little risk while dumping the money into high flying equities like Nvidia for a handsome return.

But — there’s always a “but” — on July 31, the same day as the Federal Reserve announced its decision to hold interest rates steady for one more month before beginning to cut, the Bank of Japan raised its interest rates from .1 percent to .25 percent to stop the slide of the yen against the U.S. dollar; this change came just four months after Japan raised rates above zero for the first time in 17 years.

These small but noticeable rate hikes had a profound impact on the yield on the yen, which increased in value 7.5% at the beginning of last week. That might sound good on its face. Yay! The price of yen is going up baby! Let’s pop some bottles of Cristal!

But for Wall Street whales banking on the currency to stay depressed and interest free, it was the worst-case scenario.

When the price of yen in relation to the greenback jumped, those who had borrowed now owed far more than the purchase price they bought in at, which led to margin calls, requiring borrowers to put up a larger amount of collateral if they wanted to remain in their loans that had now ballooned in cost, or be forced to immediately pay them back.

Because a healthy portion of the money that was borrowed was sunk into U.S. tech stocks, investors began unrolling their trades in those stocks to pay off their debts owed in borrowed yen.

Worst yet, because these traders began selling viciously stateside and buying-back viciously abroad, it both sullied the momentum of our stock market (as well at the price of Bitcoin), and conversely pumped Japan’s currency, which led to a currency SHORT SQUEEZE.

As more borrowers realized they were under water in their loans, more began paying them back, and as the currency debt was paid off, the more the yen increased in value, which created a nasty cyclical effect that ultimately led Japan’s stock market to crash.

Dénouement

Though Harris and Biden are intimately connected to Wall Street interests, and anyone who tells you otherwise is a fool or a liar, the yen carry trade and subsequent selloff — albeit modest and temporary — is not of their doing.

(Of note, both the U.S. and Japan’s stock markets ended this past Friday at the same levels they were the previous Friday before the sell-off, while the VIX fell below 20 to close out the week, as if Monday’s flash-crash never happened).

It’s also important to point out: you should never associate the strength of the stock market with how everyday Americans are doing — I understand this reality all too well personally.

Inflation is too high. Wages aren’t keeping up. Credit card interest rates are criminal. The housing market is inaccessible to most working-class Americans. And no matter what the talking heads and analyst worms on CNBC proclaim, for many Americans, life is more economically challenging now than it was five years ago.

Not because Trump was The Messiah, but because exiting the pandemic companies realized they could gouge customers on products we need, like groceries and gas, and there was very little we could do about it. A reality that’s unlikely to be curtailed under either a Trump or Harris administration.

Nevertheless, the stock market is the primary economic indicator DJT has pointed to time-and-again, in and out of office as proof of economic strength; ergo, if Trump were in office right now, he’d be gloating to hog heaven about how strong the stock market is.

Furthermore, the main takeaway is: no matter who is president, Wall Street and its house of cards is always up to some new gimmick, that’s always the same old gimmick, just with a slightly different twist.

Like heroin junkies they cannot help themselves. Every five to ten years like clockwork their speculative bets break America’s piggy bank—for which they should be held accountable—but are not by a congress that fails to provide proper oversight and regulation — WHICH OF COURSE THE GOP DEFINITELY DOESN’T WANT.

Generally, The Insiders get their own money out before everyday folks are left holding the bag. In the bag is a recession, layoffs, housing crashes and other excrement.

We’ll have to see if the unwinding of the carry trade is over. According to some analysts, it’s only 50 to 60% unwound.

Kit Juckes, a global strategist imparted his stance on the unfolding saga, in a message to his clients last Monday, as reported by CNN, writing:

“You can’t unwind the biggest carry trade the world has ever seen without breaking a few heads.”